In light of the new rules that came into force on 1 January 2023, we have set out an overview of the regime with emphasis on recent changes.

A. SFDR and Taxonomy Condensed Timeline

B. Overview

C. SFDR: A Reminder

D. SFDR: Rules in Force From 1 January 2023

E. Taxonomy: A Reminder

F. Taxonomy: Rules in Force From 1 January 2023

G. Next Steps and How Can We Help

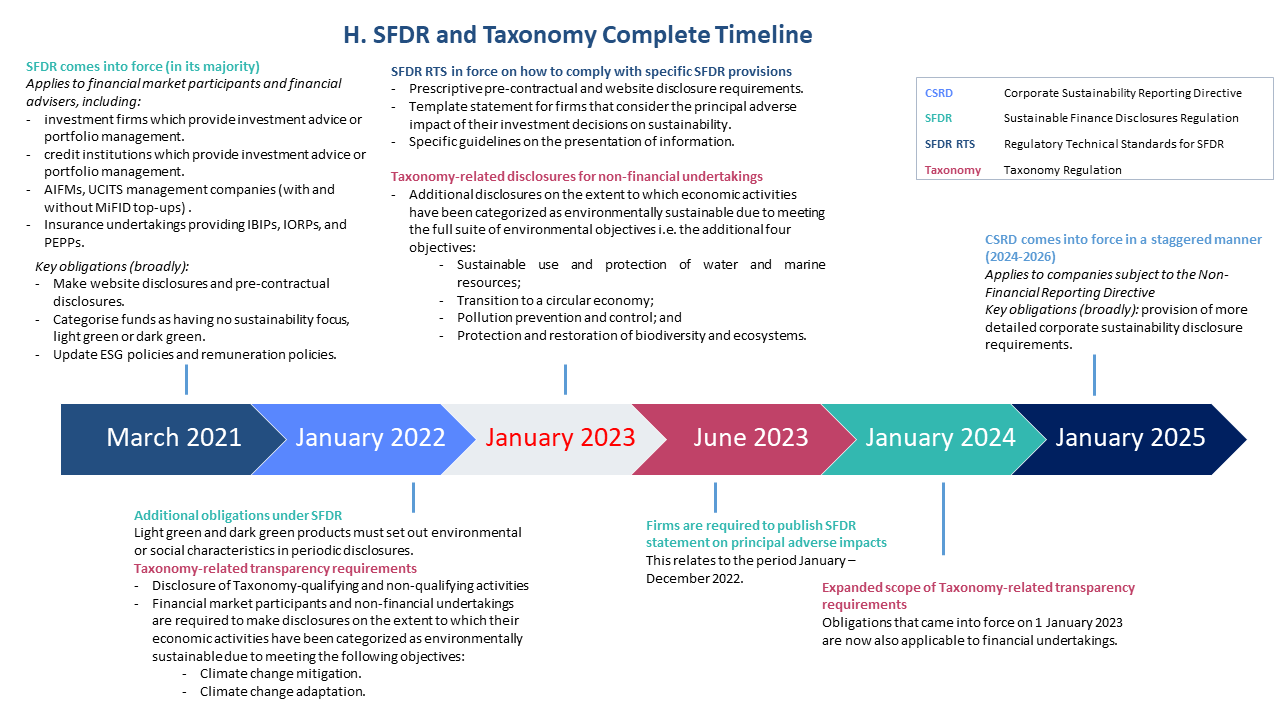

H. SFDR and Taxonomy Complete Timeline

A. SFDR and Taxonomy Condensed Timeline (See full version of the Timeline below)

B. Overview

1. The Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation (Taxonomy) constitute two core pillars of the EU’s legislative initiative to combat greenwashing and promote transparency in sustainability. The Corporate Sustainability Reporting Directive (CSRD), which constitutes the third pillar, is due to come into force.

2. Each piece of legislation applies in a staggered manner (see complete timeline on the last page). The table below provides an overview of the application of SFDR and Taxonomy today.

Summary: application of SFDR & Taxonomy today | ||

| Listed | Non-listed |

Financial market participant | SFDR applies Taxonomy applies depending on product categorisation | |

Financial adviser | SFDR applies Taxonomy applies depending on product categorisation | |

Large EU entity (meets the size test) | Taxonomy applies | Taxonomy does not apply, unless it is a credit institution or insurer |

C. SFDR: A Reminder

1. SFDR came into force in its majority on 10 March 2021 with a view to addressing greenwashing and increasing transparency relating to the environmental, social and governance implications of investment decisions.

2. SFDR applies to:

- financial market participants, which includes investment firms providing portfolio management, credit institutions providing portfolio management, AIFMs[1], managers of qualifying

- venture capital and social entrepreneurship funds, insurance undertakings providing IBIPs[2] and PEPPs[3]; and

- financial advisers, which includes investment firms providing investment advice, credit institutions providing investment advice and AIFMs with MiFID top-ups.

3. SFDR introduces the following key obligations on firms within its scope:

a. categorisation of financial products as having:

- no sustainability scope;

- promoting environmental or social characteristics (light green); or

- having sustainable investments as their objective (dark green);

b. website and pre-contractual disclosures relating to firms’ integration of sustainability risks in light of their categorisation;

c. website and pre-contractual disclosures on the extent to which firms consider the principal adverse impacts of investment decisions on sustainability factors; and

d. updates to remuneration policies.

D. SFDR: Rules in Force From 1 January 2023

1. SFDR’s Regulatory Technical Standards (RTS), which provide detailed requirements on how to comply with SFDR, came into effect on 1 January 2023.

2. Key new content:

- there are specific guidelines on the presentation of information; it must be free of charge, easily accessible and in searchable format;

- for financial market participants who consider the principal adverse impact of their investment decisions on sustainability factors, there is a template sustainability impacts statement and a list of climate and environment-related indicators; and

- there are prescriptive pre-contractual and website disclosure requirements and template periodic disclosures for financial products that promote environmental or social characteristics.

E. Taxonomy: A Reminder

1. Taxonomy technically came into force in 2020 and seeks to provide a classification system to address greenwashing and establish a uniform labelling regime for what qualifies as environmentally sustainable.

2. The Taxonomy applies to:

a. financial market participants (see definition in B above); and

b. listed companies, credit institutions and insurers captured by the definition of ‘large public interest entities’; under the definition, these entities meet the size test if on a consolidated basis, they have:

- more than 500 employees; and

- a balance sheet of more than €20m or net turnover of more than €40m.

3. The Taxonomy introduces the following key obligations on firms within its scope:

a. Financial market participants became subject to the requirement to make pre-contractual disclosures in relation to economic activities they label environmentally sustainable.

b. Large public interest entities became obliged to disclose in their non-financial statements the extent to which their activities are environmentally sustainable, including the proportion of their turnover, Capex and Opex associated with environmentally sustainable activities.

4. An activity is deemed to qualify as environmentally sustainable if it complies with the following conditions:

- substantial contribution to one or more of the environmental objectives;

- no significant harm to the environmental objectives;

- compliance with minimum safeguards relating to human rights; and

- compliance with a long list of technical screening criteria.

5. The two environmental objectives of the Taxonomy applicable from 1 January 2022 are:

- climate change mitigation; and

- climate change adaptation.

F. Taxonomy: Rules in Force From 1 January 2023

1. While Taxonomy has technically been in force for a while, a key element of the regulation, the finalization of the technical screening criteria was significantly delayed and therefore the bulk of the requirements became applicable in January 2023.

2. Key new content - Disclosure obligations for financial and non-financial undertakings were expanded in January 2023 to include the remaining four environmental objectives:

- the sustainable use and protection of water and marine resources;

- the transition to a circular economy;

- pollution and prevention control; and

- the protection and restoration of biodiversity and ecosystems.

3. These disclosure obligations involve reporting on a very long list of key performance indicators prescribed per sector, many of which are not always readily available to firms.

G. Next Steps and How Can We Help

1. A number of firms that previously opted to categorise their products as not having a sustainability focus, are now under increasing pressure to upgrade that categorisation. The reasoning around lack of clarity in the rules has become weaker as a result of the new guidance. We would be delighted to help you navigate this.

2. Firms that have become subject to new requirements in January 2023, will need to make additional periodic disclosures under SFDR and Taxonomy which we can help with.

3. Listed firms not currently strictly subject to SFDR or Taxonomy, will become subject to the CSRD between 2024 and 2026; we can help you prepare for this. In the meantime, increasing investor pressure and habits of good governance will likely drive listed firms to make ESG disclosures this year.

H. SFDR and Taxonomy Complete Timeline

Download the Briefing here.

[1] Alternative Investment Fund Managers (AIFMs)

[2] Insurance-Based Investment Products (IBIPs)

[3] Pan-European Pension Products (PEPPs)