Our Briefing provides and overview of the new EU Foreign Subsidies Regulation affecting M&A transactions: One month to go for additional prior notification obligations.

A. The European Union (EU) Foreign Subsidies Regulation: What Is It About?

B. Key Concepts

C. How Does it Affect My Company?

D. Points of Interest

E. What Can I Do Now to Prepare?

A. The European Union (EU) Foreign Subsidies Regulation: What is it About?

1. The EU Foreign Subsidies Regulation (FSR) introduces a prior notification requirement for certain M&A transactions and public procurement processes, independent of the merger control and foreign direct investment filing requirements which run in parallel.

2. It applies within the EU from 12 July 2023 with few exceptions.

3. It does not address subsidies in the traditional sense, but instead tackles financial contributions by third (non-EU) countries to undertakings in the EU.

4. The policy rationale is that these financial contributions may distort competition in the internal EU market.

5. The requirement for prior notification to and approval from the European Commission (EC) of transactions involving undertakings that have received financial support from third countries applies from 12 October 2023.

B. Key Concepts

1. Foreign subsidies within the scope of the FSR arise where a third country directly or indirectly provides a financial contribution to an undertaking engaging in an economic activity in the EU which is limited to one or more undertakings or industries.

2. Financial contributions can take many forms, including provisions or purchases of goods or services, capital injections, grants, loans, loan guarantees, debt forgiveness, debt to equity swaps and tax exemptions.

3. Third Countries providing the contribution may be:

a. a central government;

b. a public authority; or

c. a private or public entity whose actions can be attributed to the third country.

4. The foreign subsidy can relate to any economic activity. There is concentration on the public procurement process but M&As also fall within the scope of the FSR.

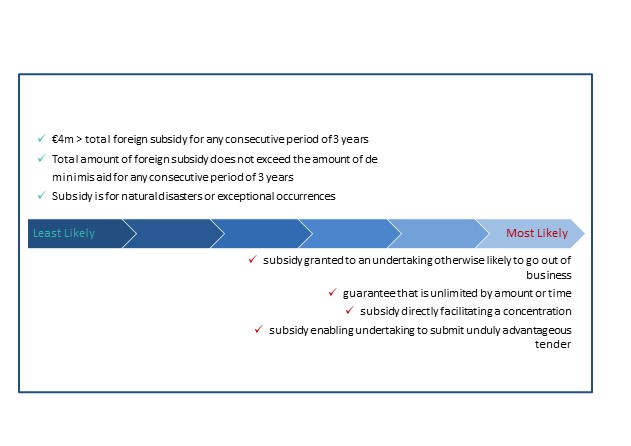

5. Distortion in the market occurs where the foreign subsidy improves the competitive position of the undertaking in the internal market and, in doing so, actually or potentially negatively affects competition in the internal market. The FSR sets out subsidy types that are least likely and most likely to distort the internal market, taking into account:

a. the amount and nature of the foreign subsidy;

b. the situation of the undertaking; and

c. the level and evolution of the undertaking’s economic activity.

C. How Does it Affect My Company and Requirements

1. Requirements for Prior Notification of M&A Transactions

a. Notification Thresholds

Undertakings are required to notify the EC of acquisitions of notifiable concentrations in M&A transactions pre-closing, if:

i. at least one of the merging undertakings, acquired undertaking or joint venture is established in the EU and has an aggregate turnover within the EU of at least €500m; and

ii. the following undertakings:

- the acquirer(s) and the target (in case of an acquisition);

- the merging undertakings (in case of a merger); and/or

- the undertakings creating the joint venture and the joint venture itself (in case of a joint venture),

received combined financial contributions of more than €50m from third countries in the preceding 3 years.

b. Form of notification

Notifications must be submitted using the very detailed form in Annex I of the Foreign Subsidies Implementation Regulation.

c. Timing of notification

The notifiable concentration shall not be implemented for a period of 25 working days after receipt by the EC of a complete notification (ie pre-notification period and Phase 1 review of 25 working days). The EC may initiate an in-depth investigation (Phase 2 review), in which case the concentration shall not be implemented for 90 working days after the in-depth investigation is opened. This deadline may be extended by 15 working days in cases of offering of commitments to remedy the distortion in the internal market. Under specific conditions laid out in the FSR, a derogation from these time periods is allowed.

2. Requirements for Prior Notification of M&A Transactions When Thresholds are Not Met

The EC has the power to request an ad-hoc notification for a transaction that is not otherwise notifiable, where it suspects that foreign subsidies may have been granted in the three years prior to the concentration.

3. Requirements for Prior Notification of Subsidies in Public Procurement Procedures

a. Notification Thresholds

Companies participating in a public procurement procedures must notify the contracting authority (eg the state or local authority) where there is a notifiable foreign financial contribution particularly where:

i. the estimated value of the public procurement or framework agreement (before VAT) is equal to or greater than €250m; and

i. the economic operator (including subsidiaries without commercial autonomy, holding companies and, where applicable, main subcontractors and suppliers in same tenders) was granted aggregate financial contributions equal to or greater than €4m per third country in the last 3 years.

A variation of the above thresholds applies where the contracting authority divides the procurement into lots.

b. Form of notification

Once the notification or declaration is submitted by the company to the contracting authority, the contracting authority shall transfer it to the EC without delay. Notifications must be submitted using the very detailed form in Annex II of the Foreign Subsidies Implementation Regulation.

c. Timing of notification

The EC carries out a preliminary review within 20 working days after receipt of a complete notification and can, upon justification, extend this to a further 10 working days but only once. Within this time frame, the EC may decide to launch an in-depth investigation. A decision regarding the in-depth notification must be made within 110 working days after receipt of a complete notification, with the EC having the right, upon justification, to extend this period by 20 working days.

4. The EC May Conduct Inspections on EU Undertakings

The EC has the power to conduct ex officio inspections of undertakings both within the EU and, under conditions, outside the EU to carry out its duties under the FSR. The EC has the power to impose fines or periodic penalty payments for undertakings not cooperating or submitting inaccurate or misleading data.

D. Points of Interest

1. The FSR applies to foreign subsidies granted in the 5 years before 12 July 2023 where those subsidies distort the internal market after 12 July 2023.

2. A foreign subsidy is considered to be granted from the moment the relevant undertaking is entitled to receive it, even if it does not actually receive it.

3. Unlimited guarantees may also be considered to create distortive results.

4. Notification is compulsory and suspensory. Failure to notify or suspend closing pending clearance may lead to severe sanctions.

5. The EC recognises the sensitive nature of some of the data and therefore accepts that, where interests would be harmed, parts of the notification can be submitted redacted or marked as confidential.

6. The Greek authorities have not yet issued any additional guidance, but these rules are directly applicable regardless.

E. What Can I do Now to Prepare?

1. Companies can put systems in place to source data from the last 3 years and monitor financial contributions, especially in the context of M&A transactions and public procurement contracts.

2. The precedent forms are very detailed and require financial contributions to be grouped per third country per type, ie grant loan, tax advantage, guarantee and debt write off. Sourcing the data early will avoid delays once a transaction arises.

3. Analyses, reports, studies or company presentations setting out the economic rationale for financial contributions or concentrations may be prepared while transactions are being contemplated as they are required to be disclosed to the EC.

4. Deal documents should also include a provision reflecting a potential FSR filing as a condition precedent and cooperation provisions in case of such filing.

Download our Briefing on EU Foreign Subsidies Regulation affecting M&A transactions: One month to go for additional prior notification obligations.